World Nomads provides travel insurance for travelers in over 100 countries. We at Hostelgeeks are not an affiliate, and we will not receive a fee when you get a quote from World Nomads. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance. We have been advised directly by World Nomads to omit specific details. We’ve retained our original guide for your reference.

Are you looking into your own travel insurance? This is a huge topic. We at Hostelgeeks are traveling full time and we had a look at a few companies out there.

Personally, we no longer use World Nomads as travel insurance.

We are currently using Heymondo and Safetywing. Personally, it is easier for us to handle and manage.

- HeyMondo Travel insurance review – our first-hand review and why we use

- SafetyWing travel insurance – pros and cons; perfect for digital nomads

Since we travel with a bit of gear and planned to do some activities like skydiving, motorbiking, diving and such, a travel insurance simply makes sense.

- 5 good reasons to get insured by World Nomads

- What is covered by World Nomads?

- How much is it?

- Standard vs Explorer Plans (compared in a table)

- Our review and Experience

- My best tips

- Safetywing Insurance

- is world nomads worth it?

- Pros and Cons in short

- Promo Code for World Nomads

- FAQ

- How to Claim

- How long does a claim take?

- Extending your insurance

- Alternatives to World Nomads

- How late can you buy travel insurance?

- Last thoughts – Opinion

This medical insurance is especially popular for US-American travelers and Australians. More on that later. Although we are sasoned travelers, the insurance is always something changing.

Do you actually need Travel Insurance?

Our best recommendation to find travel insurance: spend a bit of time and read all the terms and conditions.

Yes yes, we know and we are sorry! But here is the thing: it really depends on your trip of travel, where you are from, pre-existing injuries and such. It’s or at least can be seriously complicated, but it does not have to necessarily be.

Below we list how you can avoid getting the wrong insurance and how World Nomads can help you.

Important: We will not talk you into buying insurance. It is your own decision; we are not your parents. Obviously, we give our honest opinion as a friend, based on experienced and other traveler stories.

Please check first if you are already covered by your own insurance. Maybe you don’t need another one, check that now! If you have doubts, call your current insurance in your home country!

Important Update 2023:

We have been advised directly by World Nomads to omit specific details. We’ve retained our original guide for your reference. This is information only.

Travel insurance: simple & flexible

As stated, back in 2016 we decided to go with World Nomads. After comparing and listening to a few friends, the decision was final.

You can buy and claim online World Nomads, even after you’ve left home.

Quick and simple!

Travel insurance from World Nomads is available to people from 130 countries. That is especially useful since our team has different nationalities. It was interesting to see that the German insurance was more expensive than the Spanish.

It’s designed for travelers with cover for overseas medical, evacuation, baggage and a range of adventure sports and activities. However, you need to check with World Nomads which activities they actually include.

What World Nomads can provide cover for?

World Nomads travel insurance has been designed by travelers for travelers, to cover different types of trips. What does this mean?

Here is a list of things can they can cover:

- Delayed baggage

- Emergency Overseas Medical

- Medical Repatriation

- Death Overseas

- Emergency Dental

- Baggage Lost

- Stolen Passports

- Schengen Area Cover

- Trip Cancellation

Again these incidents CAN be covered. It all depends on the insurance you purchase. Coverage is always subject to the terms, conditions, limitations and exclusions of the policy along with the particular circumstances of the particular claim.

In regards to experiences, they cover more than 150 activities you love.

Can pregnancy be covered by World Nomads?

Any pregnancy is considered a pre-existing medical condition under the EU policy, however, this policy does provide cover for pregnancy complications which arise due to accidental bodily injury or unexpected illness which occurs while on your trip, excluding costs incurred during the period between 12 weeks before and 12 weeks after the estimated date of delivery.

This policy does not intend to cover the normal costs or losses otherwise associated with a single or multiple pregnancy or childbirth. Such normal costs include, but are not limited to, delivery by caesarean section or any other medically or surgically assisted delivery which does not cause medical complications.

Not all activities are covered under every plan.

You may have to upgrade the policy and sporting level to make sure you’re covered for everything you plan to do. Please read your policy wording carefully before you buy it.

Here’s this year’s top 10 activities under each category that World Nomads love to do:

Snow

- Bobsledding

- Ice Hockey

- Ice Skating

- Kite Wing

- Skiing

- Ski Joring

- Snowboarding

- Snow kiting

- Snowmobiling

- Tobogganing

Water

- Canoeing

- Kayaking

- Paddle Boarding

- Sailing

- Scuba Diving

- Snorkeling

- Surfing

- Tubing

- Windsurfing

Air

- Aerial Safari

- Ballooning

- Bungee Jumping

- Hang Gliding

- High Diving

- Hot Air Ballooning

- Passenger in a commercial aircraft

- Skydiving

- Tandem Skydiving

- Zip Line

Land

- Bushwalking

- Camel Riding

- Camping

- Caving

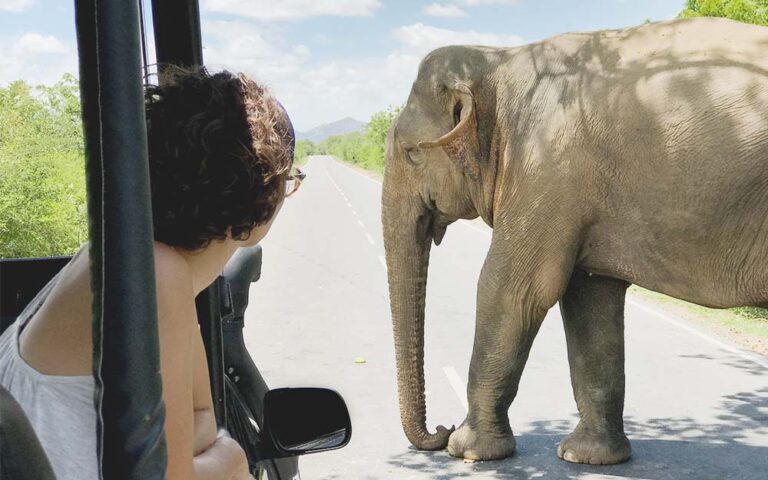

- Elephant Riding

- Hiking

- Orienteering

- Motorbiking

- Mountain Biking

- Trekking

Sports

- Baseball

- Basketball

- Cricket

- Fencing

- Go Karting

- Golf

- Hockey

- Tennis

- Ultimate Frisbee

- Volleyball

The last item on this list is experiences like WWOOFing, fruit picking etc.

This is very popular for budget travelers doing work and travel (or Work Away) in countries like Australia, New Zealand and others.

Experiences

- Childcare work

- General farm work

- Hospitality

- Restaurant

- Teaching

- Fruit Picking

- Admin work

- Ski instructor or Snowboard Instructor

- Office work

- WWOOFing

How much is it?

Before you say “Travel Insurance is too expensive”, let’s have a look.

My dad always says “Before saying you cannot afford it, always check prices first. It may be cheaper than you think“.

I have to admit, he was right quite a lot of times.

So, how much is it? I wish I could type right now a fix number for you.

But, you may have realized this already: this seems to be impossible. Again, our team has different nationalities. And everybody pays something different.

To give you an idea, we pay anything between 40€ to 90€ per month.

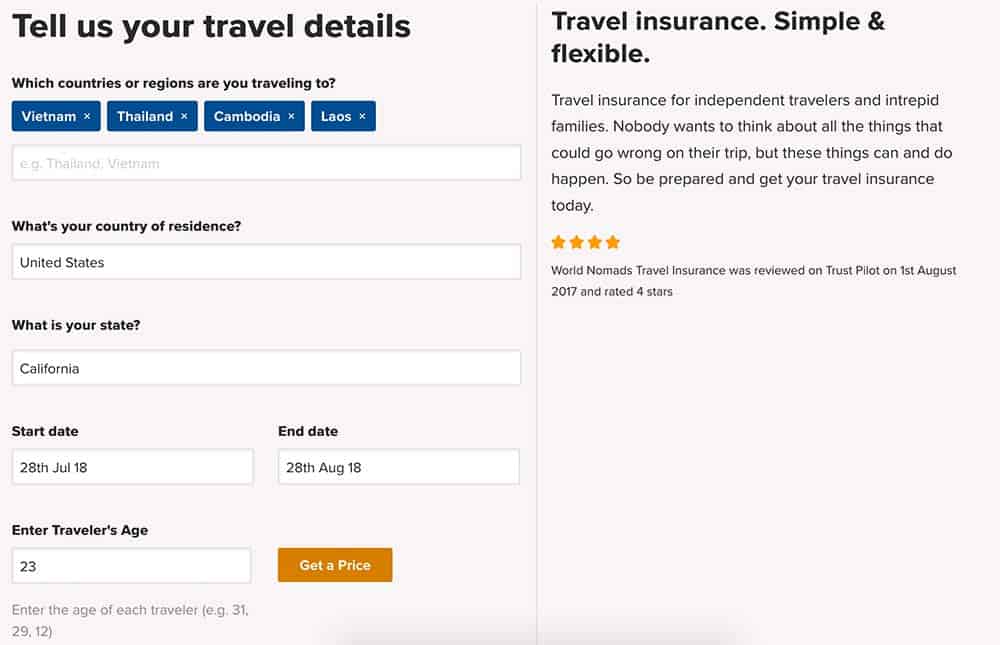

How to get your insurance with World Nomads?

Okay, by now you should have an estimated price, right?! You may be surprised how affordable it is; or how expensive and want to cancel now your trip.

Confession: I always thought it would be much more expensive. But again, my Dad convinced me to at least have a look.

Okay, let us assume you liked the price you saw. How can you take it from there?

What I really like here is that it’s super simple. And before you pay anything, you get a full, transparent quote. I cannot emphasize this enough.

First of all, the quote you receive will be depending on your

- nationality (country, maybe state too)

- your age

- the countries you are visiting and

- the duration of your travels

Above I included the form to get your first quote.

Step 1: Choose your plan

Last but not least, you can pick a different package: Standard Plan vs. Explorer Plan.

Let us talk about this a bit. Obviously, as you might have already guessed, the two plans cover different items.

Step 2: Sign Up with your Name and Email

This is pretty simple and regular too. You type in your name, surname, email address, address, maybe even an alternative travel address, date of birth and your phone number.

Your phone number is very important! Make sure your email and phone number is up to date!

Then you have to agree to the terms and conditions. Standard, again.

You have to confirm the following:

- I have read the policy wording, terms of business and insurance product information document, and agree to receive all policy document electronically.

- I have read in full and accept the privacy notice.

- I am a citizen of XYZ

- I would like to receive the latest news, deals & opportunities by email. (optional)

Step 3: Payment

And you made it to the payment form. You can pay only via credit card:

- Visa

- Master Card

- American Express

PayPal or wire transfers are not possible at this point.

World Nomads Standard vs Explorer

I created a case for you to showcase a bit better the standard vs explorer plans of World Nomads.

There is only two different packages you can choose from.

The quote below is for:

- US Citizen

- For 1 month travel (in August in this case)

- Traveling to Vietnam, Laos, Cambodia and Thailand

- Traveler’s age is 23

Below you find a detailed table.

What you’re covered for: |

Standard |

Explorer |

| Emergency Accident & Sickness Medical Expense | $100,000 | $100,000 |

| Emergency Evacuation & Repatriation | $300,000 | $500,000 |

| Non-Medical Emergency Evacuation | $25,000 | $25,000 |

| Trip Cancellation | $2,500 | $10,000 |

| Trip Interruption | $2,500 | $10,000 |

| Trip Delay | $500 | $1,500 |

| Baggage & Personal Effects | $1,000 | $3,000 |

| Baggage Delay (outward journey only) | $750 | $750 |

| Collision Damage Waiver (CDW) – where permissible | Not included | $35,000 |

| Accidental Death & Dismemberment | $5,000 | $10,000 |

| One Call 24-Hour Assistance Services | Unlimited | Unlimited |

| Adventure Sports & Activities | Standard Plan Sports & Activities as listed for U.S residents | Standard & Explorer Plan Sports & Activities as listed for U.S residents |

| TOTAL | $131.76 USD (this price is out of date. please get a quote here ) |

$190.41 USD (this price is out of date. please get a quote here ) |

So, here you have it. Personally, I was surprised how affordable it really is. For me, I decided to take only the standard plan.

The next one will be for sure the Explorer, in my case.

The reason is simple: The Explorer Plan covers Baggage & Personal Effects up to $3000. When traveling with a laptop and the newest iPhone, it’s worth it!

Our review of World Nomads Insurance

As stated in the beginning, we are fans and we use it ourselves. This is our extended World Nomads Travel insurance review for a reason.

We had zero issues, everything went smoothly.

From the consulting and many many questions we had to payment and extending the insurance.

It’s fair to say: We did not have anything to claim. We were lucky enough to had no lost luggage, no accidents or any sickness during our travels. We even didn’t lose our laptops, never got anything stolen.

*knocking three times on the table*

Even when we traveled 3 months by motorbike through Vietnam.

We hope you will never ever need any insurance. Yet, better safe than sorry.

We would love to give you a super detailed review for World Nomads Insurance.

But, here is the thing: There is no way we can write up a generic review that covers EVERYTHING!

Every insurance works different, every insurance covers different issues.

There are so many different policies, that are changing all the time. I wish I could give you the one quick super-solution, but it is clearly impossible.

Yet, this is the reason we like World Nomads.

They actually help you to pick the right plan for your travel plans. Again, it is super important that you are honest with your insurance agent. If you planning to go scuba diving, then do not pretend it is only a beach holiday.

If anything happens and you need to go to a hospital due to a scuba diving accident, no insurance in this world will cover you.

Important: If your plans change during your travel, you can always call them and upgrade your plan!

This is exactly what I did.

My own experience: I never planned to go scuba diving.

When we arrived at Gili Castle Hostel on the Gili Islands, Lombok, Indonesia, I decided to give it a go.

The local scuba instructor usually also have the possibility to sell you extra scuba insurance. I called up my insurance agent, and I was covered.

Done!

Here is world nomads phone number, listed by country:

Australian and New Zealand Residents:

- Phone: +61 2 8263 0470; or

- Phone: +61 2 8292 1470 (reverse charges* via an operator from anywhere in the world)

Brazilian Residents

- Phone:+45 70 23 24 61 (calls are not toll free. You can claim your itemised call costs)

- Text message: +45 42 41 30 00 (include your policy number in the text message. No phone calls.)

Canadian Residents

- Phone: +1 866 878 0192 (toll-free from Canada and the Continental U.S.); or

- Phone: +1 416 646 3723 (collect from anywhere else in the world)

UK and Irish Residents

- Phone: +44 20 7183 3751 (Call via an operator reverse charges*. Not toll free.)

- Phone: 020 7183 3751 (from the UK)

U.S Residents

- Telephone: +1-855-878-9588 (toll free within the US and Canada)

- Telephone: +1-603-328-1329 (toll free outside the US and Canada)

- Telephone: +1-603-328-1384 (Collect*)

Residents of all other countries

- Phone:+45 70 23 24 61 (calls are not toll free. You can claim your itemized call costs)

- Text message: +45 42 41 30 00 (include your policy number in the text message. No phone calls.)

My 6 Best tips for you

Here’s my best 6 simple tips:

- Start your research by checking if you already have a travel insurance

- Read the terms & conditions – carefully!

- Always ask if in doubt! Don’t be too proud or shy to ask twice if needed.

- Be honest on where you are and what you do

- Document all of your valuables

- Do not be an idiot

#1 You may already have insurance

Especially Europeans may already have a valid travel insurance.

And you may not need an extra one.

Or maybe you have one, but it is only valid for 30 days in a foreign country.

First things first: Call your current insurance and talk to them. If you are not covered, then consider World Nomads before purchasing something extra form your current provider.

Why?

World Nomads is highly experienced in travel. They actually know what to do in case something goes wrong, and can help you.

#2 Read the terms & conditions – carefully!

Whatever insurance you go for, it’s valuable, no, crucial to read them through.

Carefully! Do not just pick one for the peace of mind, without knowing what you just paid and what is covered, and what is NOT.

It may help to make a list of things you want to do before paying. Then go for the package that covers your adventures.

#3 Always ask if in doubt! Don’t be too proud or shy to ask twice if needed

Nobody expects you to understand every single line.

Ask your agent if anything is unclear. After all, you are the paying customer, and they are happy to help you. If you are too proud or too shy to ask, it could be really fire back on you.

What do we really like about this company?

You can contact an agent and ask everything that is not clear to you. No matter how “stupid” this question may sound to you, ask it! Do not leave anything unclear for you, you have to know what you are buying and what not.

Just let them know about your travel plans with details like

- countries you plan to visit

- your nationality

- your age

- duration of your travels

- planned activities

They will help you to find a suitable package for you. After all, this is what we did.

#4 Be honest on where you are and what you do

First of all be honest with yourself and do not pretend you will be chilling 4 weeks on the beach, when you actually want to dive, drive a motorbike, go skydiving and probably wrestle a shark.

It does not make sense to pay something that actually does not your cover your adventures.

Also, be honest when an accident happened.

Insurances have lots of experience, and if you have scratches all over the body and a broken bone in Thailand, they will probably not believe you when you say it was a cat…

Update: Worldnomads does not cover China now (4th of Aug 20). A user of our website was comparing prices, and it would not let him add China. So he went with safety wing. Please check this info before purchasing.

Per Worldnomad website when trying to enter the country;

Sorry, we’re currently unable to provide cover for China.

#5: Document (your valuables and illness)

Whatever insurance you will be choosing in this world, when you have to claim something, you have to document all your valuables or illness.

When you have been sick, make sure you take a copy of your hospital bill or medication bill. You will need this. Best, fastest and easiest way to do this is with your phone and sending it to your emails. This way you have an instant backup.

In the unfortunate event something has been stolen, take a photo or make a copy of the official police report. Again, take a photo and send it to you via email.

Also, when your things got stolen, you have to provide receipts for all items.

You cannot go and claim a $3000 laptop without a receipt. I know, that is quite an annoying part. But sorry, quite necessary.

Read: Are hostels safe? 13 safety tips

Best way to do this: Document all your belongings before hitting the road. Unpack your final backpack or suitcase and take photos of all items with bill/ invoice if possible.

#6: Don’t be an idiot

Sorry, I do not mean to make you feel bad, but please please: Do not be an idiot.

Buying a travel insurance does not make you invincible or immortal. You won’t suddenly become a super hero that can drive the fastest motorbike in the world on a German highway with 350 kilometers per hour.

You cannot suddenly drive a motorbike with flips flops and without a helmet. You cannot suddenly fight a tiger!

Okay okay, your get my point.

I am only emphasizing this since we have seen so many travelers that experienced bad accidents. Especially in South East Asia. Once you travel around this area of the world, you will see many fellow travelers with many bad injuries…the moment you see it you know what I mean here.

Read: Big guide on 39 travel safety tips; both offline and online.

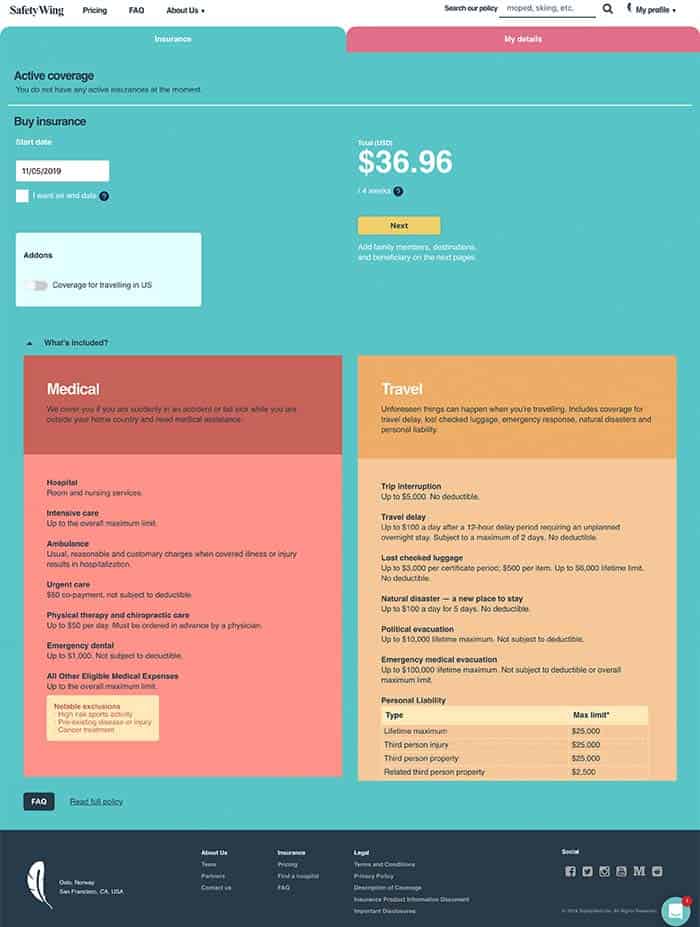

SafetyWing Insurance

SafetyWing is another option if you are traveling, specially if you are looking for a nomad insurance. It costs around $40 for the full month, so it is very affordable to begin with.

We wanted to test Safetywing for two reasons:

- We can have our team of remote travel-ninjas insured

- write another review for you, my dear reader!

However, and this is important, Safetywing and World Nomads are very different. More on that below.

We have now a full review of Safetywings. There we share our complete experience and compare it to World Nomads.

Here is our first impression.

The sign-up process was super smooth. I was really impressed by the simple and fun design. It seems like they do want to take away the complicated part getting insurance.

Now, that does not mean, insurance is suddenly easy. Always, and we mean, ALWAYS read what is exactly covered. We cannot state this enough!

Once you signed up, there a simple main screen with two tabs: either you can get your insurance or go to your profile. Make sure you fill out your profile completely. You have to fill out your citizenship, phone number, email address and your actual home country and mailing address.

The more interesting part however is the insurance tab.

Check how much your next trip could cost you in travel insurance. My upcoming 3 months trip to Colombia will be €121.44 (roughly $40 per month).

Update: We have used now Safetywing from December 2019 to March 2020. We had no accident so we had not to do a claim with Safetywing. However, since February and March the Coronavirus hit. We got constant updates on how they could evacuate us under what circumstances.

It did not apply to us since we have been to Mexico and there the situation was fine. We did not want to take any risks and paid our own flight back to Europe. The communication by Safetywing was great and useful.

Now, there is always two sides to a travel-related insurance. Under “What’s included?” you have all the details of medical and travel related insurance. They state:

Medical

SafetyWing covers you if you are suddenly in an accident or fall sick while you are outside your home country and need medical assistance.

- Hospital

Room and nursing services - Intensive care

Up to the overall maximum limit. - Ambulance

Usual, reasonable and customary charges when covered illness or injury results in hospitalization. - Urgent care

$50 co-payment, not subject to deductible. - Physical therapy and chiropractic care

Up to $50 per day. Must be ordered in advance by a physician. - Emergency dental

Up to $1,000. Not subject to deductible. - All Other Eligible Medical Expenses

Up to the overall maximum limit. - Notable exclusions

· High risk sports activity

· Pre-existing disease or injury

· Cancer treatment

Travel

Unforeseen things can happen when you’re travelling. Includes coverage for travel delay, lost checked luggage, emergency response, natural disasters and personal liability.

- Trip interruption

Up to $5,000. No deductible. - Travel delay

Up to $100 a day after a 12-hour delay period requiring an unplanned overnight stay. Subject to a maximum of 2 days. No deductible. - Lost checked luggage

Up to $3,000 per certificate period; $500 per item. Up to $6,000 lifetime limit. No deductible. - Natural disaster — a new place to stay

Up to $100 a day for 5 days. No deductible. - Political evacuation

Up to $10,000 lifetime maximum. Not subject to deductible. - Emergency medical evacuation

Up to $100,000 lifetime maximum. Not subject to deductible or overall maximum limit.

It all sounds very good, right? Read all the pros an cons of SafetyWing in our full review.

Difference between Safetywing vs HeyMondo

- SafetyWing is best for <40 years demographic

- For <40 years – especially as age and duration increases it becomes more expensive

- For travelers of +50, World Nomads may be the better option

- Prices for US travel insurance is noticeably higher with SafetyWing. The cover for travellers from outside US may be too low for some of their more expensive hospitals to accept entry

- World Nomads covers more activities than SafetyWings including:

- Aussie Rules

- Bobsleigh

- Boxing

- Hag Gliding

- Ice Hockey (indoor only)

- Kite Surfing

- Martial Arts

- Mountaineering +4500m

- Quad Biking

- Paragliding

- Parachuting

- Parasailing

- Rugby

- White Water Rafting

- Athletics

- Marathon

- Triathlon

You see, there is a big difference really. As always, I recommend having a closer look on what your insurance should cover.

When doing lots of kite surfing, then obviously you need an insurance covering that.

Is world nomads worth it?

A world nomads travel insurance is definitely always a good and safe idea!

Now, if World Nomads is worth it? If you actually need travel insurance, then YES!

I am not gonna lie to you, there are obviously more agencies offering this service. It’s important to mention this, because we want you make a good decision about this issue here.

But, here is the thing: A few insurance providers of our friends from Germany and Spain for instance cover certain activities and a time frame for traveling abroad. If you have an insurance that covers already your travel plans, then you do not need to get anything extra.

Please pay attention: Ask your actual health insurance first what is covered – and what is not!

Therefore, here is our action guide to insurance:

Call up your own health care in your countryAsk them:What is covered?What is not covered?Do they have an own travel insurance?

Ask World Nomads for ratesWhat is covered?What is not covered?

Compare the prices and coverage with Worlds Nomads vs your own insurance

In our case our health insurance would have been the same price as World Nomads. We decided to go with World Nomads. Why? They have the experience! Our own health insurance was not really experienced with travelers around South East Asia. Inside Europe they were really experienced. Hence, we are Europeans. Yet, we wanted the coverage more for Thailand, Vietnam, Malaysia and Indonesia, Sri Lanka and Maldives.

Quick real story: I twisted my knee and broke my meniscus in Bali.

Painful, very painful…VERY painful.

Needless to say I had to go to the hospital. The simple treatment (X-ray, crutches and pain killers) cost me whopping $350. The worst part? I had to pay it out of my own pocket. My insurance just expired after 4 months traveling. And I thought: Well, I never used it, I don’t need it…

Well, that backfired in many ways!

I was lucky though since it was “only” $350. Surgery and such could get easily in the thousands…

And if that was not bad enough, I almost broke my arm in Vietnam.

Of course, it was a small motorbike accident. Luck was on my side, it was only a massive bruise for around 3 weeks.

FAQ about World Nomads

Here we walk you a bit through common questions we had to ask ourselves before purchasing our first insurance.

Questions?

If you have any other questions, please leave a comment below.

We would be happy to add this to the list so we all help with our fellow travelers to make a better choice.

Does World Nomads Travel insurance cover Coronavirus (COVID-19)?

Yes, if it is a medical prescription. Kindly note if the country requires to quarantine until you get the results and you do not test positive it won't be covered.

Can you get insurance while already overseas?

Yes! You can get your health insurance whenever you want. You can also always extend.

How late can you buy travel insurance? Could you buy it after your accident?

You can buy your travel insurance whenever you want. There is a 3 days waiting period (72 hours) from the time you buy the policy until your cover starts. Basically, you cannot buy your world nomad insurance today and make a claim 10 minutes after. That does not work.

What about pre-existing medical conditions?

This policy changed in 2017 and is worth it to keep an eye on. Pre-existing conditions, unless they are controlled and stable, are not covered for

- Trip Cancellation,

- Trip Interruption,

- Accidental Death and Dismemberment,

- Emergency Sickness Medical Expense,

- and Emergency Accident Medical Expenses.

World Nomads Claim - how does this work?

It could not be easier: do it online! If you're a World Nomads member (I recommend to register with them and have an account), you will just need to log in and follow the claims path. There is a tab for claiming your insurance. Here you also have to upload/ attach your supporting documents like medical statements, bills etc.

How long will it take to settle a claim?

Most claims with World Nomads take between 1 - 2 months to settle. It takes a while. But, this is normal for any insurance - whether it's your car insurance, health insurance, travel insurance. It does not matter.

Can you get insurance while already overseas?

Yes! You can get your health insurance whenever you want. You can also always extend.

How late can you buy travel insurance?

Another very good question, how late can you actually buy travel insurance? And could you buy it after your accident?

You can buy your travel insurance whenever you want. There is a 3 days waiting period (72 hours) from the time you buy the policy until your cover starts.

Basically, you cannot buy your world nomad insurance today and make a claim 10 minutes after. That does not work.

What about pre-existing medical conditions?

This policy changed in 2017 and is worth it to keep an eye on.

Pre-existing conditions, unless they are controlled and stable, are not covered for

- Trip Cancellation,

- Trip Interruption,

- Accidental Death and Dismemberment,

- Emergency Sickness Medical Expense,

- and Emergency Accident Medical Expenses.

What is a pre-existing condition?

Pre-existing medical condition is where you, a member of your travelling party, a close relative or any other person upon whom your trip depends has, at the time of policy purchase:

- An ongoing medical or dental condition, or related complication, the symptoms of which you are aware, or that is currently being or has been investigated by a medical practitioner, dentist or a chiropractor; and/or

- a medical or dental condition for which advice, treatment or medication has been prescribed by a medical practitioner, dentist or a chiropractor within 180 days before you purchased your policy.

If this applies to you, then check with your agent directly.

Again, it is not worth it to lie about it. Be open and upfront with what you got, what you want. This, and only this, will pay off.

World Nomads Claim – how does this work?

It could not be easier: do it online!

If you’re a World Nomads member (I recommend to register with them and have an account), you will just need to log in and follow the claims path.

There is a tab for claiming your insurance.

Here you also have to upload/ attach your supporting documents like medical statements, bills etc. No worries, the claims path is easy. To settle any claim, you need to send in certain documentation. World Nomads Insurance strongly suggests that when you do this you take photocopies so that if items get lost in the mail, they can avoid further settlement delays.

Depending on the type of claim the documents can be:

- Any reports or reference numbers obtained from the police,

- hospitals or the responsible authority.

- Proof of purchase for all lost, stolen or damaged items.

- English translations of all documents (not required for UK/Irish residents).

Therefore:

Step 1: complete submission of your claim online

Step 2: get your documentation together

We already mentioned this. We recommend to document all your valuables before you hit the road. This makes things so much easier.

Step 3: send in your documentation (everything is online, no post office or mail is needed!)

Now you only need to keep an eye on your account in World Nomads. The agent might get back to you with further questions or requests for other documents (if needed).

Important: Always get the bills and official documents from the doctor, hospital, police! Again, take a photo with your phone and send it to you via email.

They have the support 24/7 and all year around. You are covered!

How long will it take to settle a claim?

It takes a while. But, this is normal for any insurance – whether it’s your car insurance, health insurance, travel insurance. It does not matter.

Most claims with World Nomads take between 1 – 2 months to settle.

Others can take longer than that. This often depends on how quickly you can get the required documents, answer further questions etc, as stated above.

Important: No insurance in this world can instantly resolve your claim.

This is almost impossible since there are a few steps an insurance company has to follow before they can reimburse you for instance.

Extending your insurance

You can buy your insurance on a monthly basis. Once it expires, or actually before it expires, you will get notified via email.

You can always extend your insurance. All you have to do is to log into your account, and choose your package again. You can always upgrade and downgrade. This is up to you.

Real-Life Claims with World Nomads

When it comes to insurance, usually there is some big story behind we all want to avoid.

In a recent podcast, World Nomads featured an interview with a teacher who survived a gas station explosion in Cambodia with life threatening injuries. Her first hand account of how the World Nomads EA team helped her (even flying out her Mum to be with her in the process) is extremely eye opening!

Alternatives to World Nomad

Is world nomads good travel insurance? Yes it really is, we experienced it first-hand.

Yet, I am not going to pretend World Nomads is the only travel insurance in the world. There is obviously many agencies, like BMC Travel insurance, True Traveller Insurance, IMG Patriot, Orbit protect insurance. There is also cheaper travel insurance than world nomads.

Update: As mentioned before, we have a full review of Safetywings.

Make also sure you read our detailed review of Heymondo. One of the better alternatives to World Nomads.

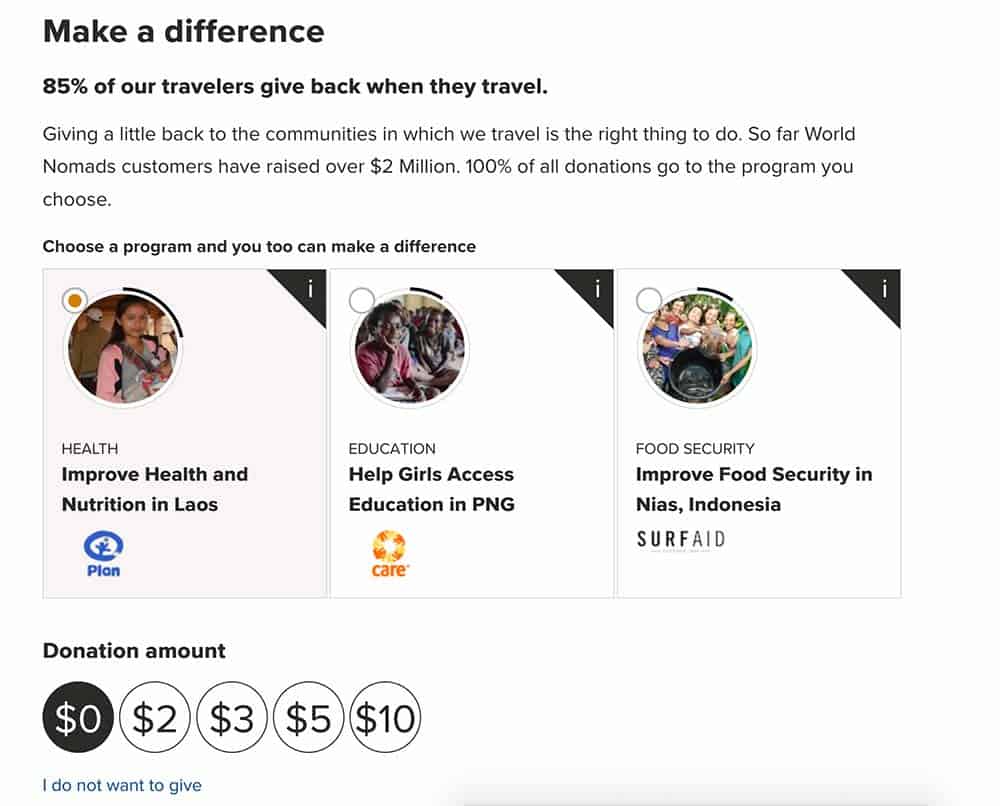

Make a difference: Donation

Just on a side-note, I would like to mention the NGOs World Nomads works with that you can support.

Giving a little back to the communities in which we travel is the right thing to do. So far World Nomads customers have raised over $2 Million. 100% of all donations go to the program you choose.

During your process of purchase you can choose between 3 programs to support. You can donate between $0 and $10. You can also decide not do donate, no worries!

Why is Travel Insurance so complicated?

First of all, everything around insurance is complicated.

It is only in rare cases you can get an insurance and EVERYTHING is covered under all circumstances, whatsoever.

Anyways.

The world of travel insurance is even a bit more complicated, if you will, because it all depends on your nationality. There is different rules for US Citizens, for Spaniards, for Australians, for Africans, well, for everyone actually.

When visiting World Nomads for instance, you have to choose your own country first to see what is covered in your case.

What if something gets stolen?

Here is what World Nomads states for US Citizens, for instance:

There’s cover to claim up to the policy limits if:

- luggage and personal effects are stolen, accidentally damaged or lost on your trip.

- checked-in bag is stolen, lost or damaged by a common carrier (like an airline or bus company).

- travel documents, traveler’s checks or passport are stolen, accidentally lost or used fraudulently.

- sporting equipment when lost by the carrier or if it’s damaged (while not in use) or stolen.

The maximum amount you can claim for all your belongings and personal effects is $3,000 per insured person with a maximum claim amount of $500 per item for an Explorer policy; or $1,000 per insured person with a maximum claim amount of $500 per item for a Standard policy.

This means as well if something gets stolen in your hostel, this would be covered. Just the amount of cash is the remaining question.

Especially when traveling with a laptop, the Explorer Package is the better option.

Last notes about Budget Travel and saving money

We know, Budget Travel means you save money wherever you can.

Finding the cheapest flights, hotels, hostels, activities, free things to do…you name it! Backpacking is fun, traveling is a lifetime experience. The more borders you cross, the better.

Yet, there are a few things that are really essential. I remember in a forum a traveler once asked “Do I really need vaccinations?“.

There is really a limit to saving money; risking your health is out of limit.

The most important thing you have: Is your Health!

Not having an insurance can really bite you in the a**. And I have to say again, please to not be an idiot. Yet, that goes with and without insurance!

Read: 10 most common backpacker mistakes

We are not trying to make you afraid, it will be your final decision. But we want to give you a few tips on the hand on WHY insurance makes sense, but also HOW you can avoid stupid accidents and limit the risk.

The most important thing you have: your Health!

Why do I mention this?

We have seen quite some crazy people not caring a bit about their health.

Examples?

- That girl that wanted to save money on essential vaccinations, but traveling to exotic destinations.

- That hostel girl we met in Lombok that had a terrible scooter accident in Bikini and shorts – and was bleeding all over. No bone was cracked, but she had a “souvenir” for the net 6 months, this is my guess on how long her skin needs to recover

- That guy in Vietnam who drove a motorcycle in Flip Flops and then wondered why his feet got burned….

- That guy in Chiang Mai driving a motorbike without a helmet

- This girl in Bali that passed out drunk as a monkey on the beach and got everything in her pockets stolen.

You see, there’s a few things you can limit.

The best insurance is the one you will never need, but is always there!

I am not trying to scare you. Again, this is a genuine article. Whenever I write an article for our readers, I only give recommendations I would give my sister.

Over to you

Do you have any questions? Anything unclear?

Please leave us a comment below.

We would be keen to help, and we would love to make this review even better.

Also, we would love to hear your own review of World Nomads Insurance. Have you had any experiences? How did you use it?

We would love to have you on board and hear your positive and negative feedback.

Just leave a comment and let us know! We want your real experiences with the company! Please remember to use proper language. If your review of World Nomads has bad language, we cannot publish it. And again, we want your actual experience. It will help the whole travel community!

What’s next?

We collected for you the most amazing hostels in the world; from wineries to castles, island retreats and monumental buildings.

Check out as well the best hostels in the world, the 5 Star Hostels.

Here is more reviews of our favorite travel platforms:

- Our favorite ways to find flights – Skyscanner in review

- Who to fly with? Qatar Airways in review and Etihad from Abu Dhabi

- HeyMondo Travel insurance review – is it legit?

- SafetyWing travel insurance – pros and cons

- Hostelworld in review – how to use it properly

- Get Your Guide – the best platform for booking tours?

- Klook.com – ideal for finding global experiences

- Onward Ticket – save money, time & stress at the airport

- Omio – book travel transport easily & save money

Safe travels and take care,

The Hostelgeeks

– – –

pin it for later