Safetywing provides travel insurance for travelers in over 100 countries. We at Hostelgeeks are an affiliate, and we will receive a fee when you purchase insurance with Safetywing – at NO Extra cost for you. We do not represent Safetywing.

Looking into buying travel nomad insurance? This can be a pretty boring, mundane task. But it’s one that is necessary.

This is a complete guide on things you need to know, things to avoid, prices and stuff to remember. We will walk you through the process, step-by-step, comparing services. (Please read until the end, important!)

We compare several websites: the famous HeyMondo, IMG Global, , Allianz Travel Insurance True Traveller, Safetywing Remote Health and the new-comer SafetyWing.

Key Takeaways

- You may already have a worldwide travel insurance included with your home insurance. Check this first.

- Prices start from $42/ month

- HeyMondo and Safetywing are both great – but different in few aspects. Check this comparison table to see what fits best your personal needs.

Insurance nomads are becoming the new norm. So if you’re planning on wandering (or already are), it’s a good idea to take a look around the internet and search for a travel nomad insurance plan that works for you.

Most digital nomad insurance is complicated, requires too much research, too much sifting through too many options and categories and potentials.

.safetywing-price-widget, .safetywing-price-widget header, .safetywing-price-widget main, .safetywing-price-widget footer {

max-width: 100% !important;

}

SafetyWing streamlines the whole process and makes for a headache-free (or at least headache-reduced) search for digital nomad travelers insurance, or travel insurance for travellers looking to get lost and/or found in this big, beautiful world we’re part of.

- What type of insurance is good for you

- 6 things you should know before you buy

- 3 good reasons to get insured by SafetyWing

- How much does it cost?

- What’s included in SafetyWing?

- Things That Could Be Better

- FAQ

- How to make a claim with SafetyWing

- Proof of insurance for a visa letter

- More FAQs

- Summing It Up

- Not To-Do’s

- How does SafetyWings Compare?

- Some other Travel Insurance Options

- Covid-19 – which travel insurance covers Coronavirus?

- Closing Remarks

Discloser: This is a genuine guide. We’re not trying to talk you into buying insurance, yet we think it is an important topic that you should keep in mind if you’re traveling or planning on it. Please check first if you are already covered by your insurance back home. If you need additional coverage, then this is the perfect guide for you.

We also decided to team up with SafetyWing and HeyMondo Travel Insurance. Meaning, when you purchase your nomad insurance through their links, we will receive a small cut at no extra cost to you. We have read a bunch of SafetyWing and HeyMondo Travel Insurance reviews so we are confident that we can help you in making a decision.

So if you are wondering, what is travel insurance, and do I need it? Let’s dive right into it. There are many things you need to know before you go and get nomad insurance.

What is travel insurance?

And what type of insurance is good for you?

Before I get into SafetyWing, it will be useful to take a look at some different types of travel insurance offers out there. Some travel insurance should really be called “holiday insurance“.

They normally cover short vacations no more than three months, and some require quoting expenses or showing proof of round-trip airline tickets.

Other plans cover only medical emergencies but not travel related expenses like travel delays or lost baggage.

Yet again, other plans only cover travel related expenses and not medical emergencies. It’s important to be discerning about your options.

Compare prices of SafetyWing vs Hey Mondo

Here’s a list of some options you may see while searching:

Travel Medical Insurance

Only covers medical emergencies, not travel related expenses.

Travel Insurance

Only covers travel expenses like trip interruption, long flight delays and lost baggage.

International Health Insurance

Some companies like IMG Global offer this option for people living/working internationally for over a year. However, they are usually more expensive than SafetyWing or HeyMondo.

Local Insurance

If you’re planning on staying in one place for a while, and end up getting a residency permit, you may have the option (or be required) to purchase health insurance from a provider in the country where you’re staying.

This usually involves the extra effort of applying for residency, and is only worth it if you’re staying in a country for over three months.

Depending on the country, the insurance can be quite cheap.

In Turkey, for example, a foreigner’s health insurance can cost as little as 200 lira (35 bucks) for a WHOLE YEAR.

The cool thing about these companies (and TrueTraveller if you live in the EU and UK) is that you can bundle all these options into one sleek and affordable plan.

Yes, I used the word ‘sexy’ in an article about insurance, although I don’t advise typing ‘sexy insurance’ into your web browser.

6 Things you should know before you buy

Let’s look for a second at some things to take into consideration while you’re searching for a travel insurance package that fits your needs.

- Am I already covered?

- What is a Deductible?

- Scope of Coverage

- Where are you going?

- How long will you be travelling?

- What will you you Be doing and who are you doing it with?

1. Am I already covered?

Before you start looking for travel insurance, check with your insurance provider in your home country for international travel! SafetyWing covers people from 175 countries.

If you’re from the US, then you’re probably not. But if you’re from Europe or the UK, you might be covered while traveling around Europe.

It’s definitely worth checking.

Don’t waste time and energy looking for your keys while they’ve been in your pocket the whole time.

On that note, many home insurances only cover a certain amount of time in foreign countries. Best would be to call them up and ask them about your specific case. Let them know how long you plan to travel and where. Ask as well what you need to do in case something happens.

Check out also your private medical insurance plan – if you have it – back home.

Many medical insurances that people have in their country cover some days abroad (might not cover all the countries, or have limits in days or amounts). As each medical plans have different conditions, make sure you check yours – if you have any.

Compare prices of SafetyWing vs HeyMondo

2. What is a Deductible?

Always an important aspect of any insurance, though sometimes mysterious and not understood properly.

A basic description of a deductible (also known as excess) could be useful for your travel insurance search.

Basically, if something bad happens, a deductible is the amount of money you pay up front before the insurance company pays out your claim.

Usually, the higher your deductible, the lower the cost of your monthly premium.

Example? Here you go.

Let’s say you cut your hand and need to go to the hospital for treatment that costs $1,000.

If your deductible is $200, you’ll pay that up front and the insurance will pony up the remaining $800.

If your deductible is $1,000 in this same scenario, then… well, do the math.

Keep in mind: deductibles are basically a risk/reward gamble.

How much am I willing to pay now? vs. How much am I willing to pay if something bad happens?

3. Scope of Coverage

Ask yourself: “What is covered with a travel insurance and what isn’t?”

As I’ve already mentioned, there are a few different coverage options that span different amounts of time and cover different terrible potential situations.

So, it’s important to pay attention to details to see what you may need vs. what is covered in the plan.

If you’re looking for a plan that handles more than just emergency situations.

Your best bet is to check out International health insurance plans, which can also be used as primary health insurance, and cover things like routine check-ups and preventative care.

Note: SafetyWing is working on expanding their coverage to include this in the future (more on that later). We are currently looking into that, for getting insurance for the whole team.

4. Where Are You Going?

There are a couple things to take into consideration when it comes to how travel insurance works in different countries.

First of all, the cost of your insurance can vary depending on where you’ll be traveling to.

And while the differences in cost among different companies may be marginal, it’s something worth being aware of during your search.

Good to know: many companies don’t offer coverage in countries like Cuba, North Korea and Iran, so pay attention to that as well.

Update: Worldnomads does not cover China now (4th of Aug 20). A user of our website was comparing prices, and it would not let him add China. So he went with safety wing.

Per Worldnomad website when trying to enter the country;

Sorry, we’re currently unable to provide cover for China.

Another thing to be aware of is the remoteness of your destination.

If you are somewhere out in the bush in Mozambique and something bad happens, you may need medical evacuation by air or ground to the nearest hospital, which can get expensive.

Certain plans have varying degrees of medical coverage, so if you know you’ll be going somewhere really out there, definitely keep this in mind.

Compare prices of SafetyWing vs HeyMondo

5. How Long Will You Be Travelling?

If your answer is ‘indefinitely’, then definitely check out SafetyWing and HeyMondo Travel Insurance.

They offer the most flexible and easily renewable plans for digital nomads and independent, long-term travelers.

In fact, SafetyWing is the perfect nomad insurance for travelling longer than 1 year. By default the insurance won’t even give you an end date. This insurance is built for long-term travellers.

Check the options!

You can create recurring payments, like a subscription. So useful and simple! Just make sure you end your subscription when you are no longer travelling.

Other companies like IMG Global, True Traveller and others offer long-term packages as well.

I’ll talk about those two companies towards the end of the article. After all, this is a complete guide.

6. What Will You Be Doing and Who Are You Doing it With?

Do you plan on doing adventure activities like scuba diving, mountain biking, hiking at elevation, parasailing and the like?

Will you be travelling with expensive electronic equipment?

Do you have kids or a spouse?

These things may affect the cost of your insurance premium.

Make sure you check all these items. Also, in case you decide later to do something else, for instance diving. You can call and ask if this is covered as well. Most of the times, the regular activities are covered.

Why buy travel insurance from SafetyWing?

Is SafetyWing a great digital nomad insurance? Well, they have a lot of pros.

Here are 3 main ones:

- Backed by the insurance giant Tokio Marine.

- Hassle-free application process.

- Super affordable pricing.

SafetyWing is a newcomer to the insurance world.

Launched in 2017, the SafetyWing founders are from Norway but the company wasn’t started in Norway; they are nomads and created the start-up directly in San Francisco. This is where they’re now based as expats.

Their aim is to provide good, affordable healthcare specifically for digital nomads and long-term travelers.

Since it is backed by the insurance giant Tokio Marine, there is no dealing with multiple insurance companies depending on your nationality/location.

This makes for a very streamlined, easy-to-use website and application process.

Furthermore, this eliminates a lot of the headache of comparing plans and worrying about whether or not you’ll be covered here or there.

That is one of the most attractive aspects SafetyWing. It’s like the iOS of travel insurance.

Good to know: They’re also working on expanding into primary care health insurance.

Which would be an awesome addition to the digital nomad insurance world, and give world travelers an excellent option for both emergency medical care and primary/preventative care.

Meaning you could go get a check-up and be covered.

Compare prices of SafetyWing vs HeyMondo

How much is travel insurance – the costs?

The other most attractive aspect of SafetyWing is the price. It’s super affordable compared to just about any other travel insurance.

Take as an example a 32 year-old male:

With SafetyWing it costs $42 for four full weeks of coverage. At first glance, it is by far the cheapest long term travel insurance.

Compare that to HeyMondo or as well HeyMondo, which would cost me $120 for their standard plan and $210 for their explorer plan.

Why do I want to emphasize the first glance? Remember there is also a yearly $250 deductible. Depending on your medical needs, SafetyWing can be more expensive than HeyMondo.

Let’s have a look at one simple insurance travel services example with different hospital bills:

- You need to go to the hospital in Bali and the hospital bill is $10

SafetyWing: $42 monthly plan + $10 hospital bill (due to the $250 deductible).

WorldNomads: $120 standard plan.

No insurance: 10$.

- You need to go to the hospital in Bali and this time the hospital bill is $300

SafetyWing: $42 monthly plan + $250 hospital bill (due to the $250 deductible).

WorldNomads: $120 standard plan.

No Insurance: $300.

Well, you can see with this simple example that insurance is about how much you are willing to pay for your peace of mind status. You will never know in advance if you will use the insurance or not and how much the hospital bill will be. Of course, you can do some research to check the hospital prices. If you are traveling to many countries or non stop, this research can take lot of time and you won’t be 100% certain of the information you find in the online world as it changes continuously.

This example is obviously very very simplified. Just imagine you have a serious issue and the costs climbs to $10.000. In this case, it is not even a question anymore if it travel insurance is worth it. This really depends on your destination, preexisting conditions and your own wallet.

Detailed breakdown of SafetyWing pricing:

If you want to include travel to the United States, and you’re not a US citizen, prices nearly double from the $42.

Even still, the price of coverage if you want to include travel to the United States is still significantly cheaper than most other companies.

What’s included in SafetyWing?

Let’s look at some of what SafetyWing has to offer:

- easy and understandable website.

- $250,000 maximum limit.

- flexibility.

- covered everywhere outside your home country except for Cuba, Iran and North Korea.

- autopay – your insurance will be charged automatically every month.

- you can get insurance for a travel companion or child.

- if you’re already abroad, you can still buy insurance at no extra cost.

- emergency dental care.

- unlimited renewals.

- emergency medical evacuation up to $100,000.

- trip Interruption up to $5,000 (I’ll get into the specifics of this one later in Not To-Do’s)

- direct billing to hospitals listed on their network.

- covered in your home country (read details below!)

Home Country: With SafetyWing you are covered in your home country for 30 days within every 90-day period (or for 15 days within every 90 days if you’re from the US).

Direct billing: As for direct billing, this means that you won’t have to pay out of pocket for medical treatment and then get reimbursed later. (Note: remember the $250 deductible).

This network does have some limitations, however. (I’ll explain in the next section)

A wide range of adventure sports activities are covered. Some popular ones include:

- Camping under 4,500 meters

- Baseball

- Horseback riding

- Bungee jumping

- Football (soccer)

- Hot air ballooning as a passenger

- Jet skiing

- Moped biking (if you have an international license and this is valid in the country you are riding)

- Safari tours

- SCUBA diving (if either you are PADI/NAUI certified, or with a certified instructor no more than 10 meters below the surface)

- Windsurfing/ Wakeboarding

- Zip line

For an exhaustive list, see their website SafetyWing.

Good to know: Some of the less expensive problems that arise feature no deductible.

For example, if you lose your passport, you’re covered up to $100 with no deductible, or if your checked baggage is lost, you’re covered up to $6,000 lifetime with no deductible.

This may be not so great if you’re carrying expensive camera equipment.

Things That Could Be Better – the Cons

I’m splitting hairs here, because on the whole SafetyWing seems nearly too good to be true, with a combination of affordability, ease of use, and necessary coverage.

But let’s look at some potential problems that you might encounter with a plan from SafetyWing.

- limited coverage options

- location restrictions

- lost baggage

- out of network Hospitals

- doesn’t cover pre-existing conditions (no insurance will cover them)

- some extreme sports and activities aren’t covered

While many sports and activities are covered under SafetyWing, some of them aren’t. These include:

- Whitewater rafting

- Hiking at elevations of 4,500 meters or higher

- Parachuting

- Paragliding

- Kitesurfing

- Parasailing

- Tractors (whatever that means)

And last but not nearly least: Running with the bulls in Spain.

Please, please, please, don’t tell me that the thought, ‘Hey, maybe Running with the bulls in Spain is covered in my travel insurance plan’ has ever run through your mind.

Although it’s come up enough to make it onto the list of sports activities excluded in SafetyWing’s coverage.

How do you make a claim?

If something bad happens to you while traveling, it’s really important that you save all the documents, physicians reports hospital statements and any other medical bills that you accrue during the process.

Without these, you may have trouble making a valid claim, and this is true for pretty much any insurance company covering pretty much anything.

That said, like a lot of other companies, you can file your claim with Safety Wing either online or through the post.

Be sure to include the following:

- A completed and signed Claimant’s Statement and Authorization form, which you can find on their website and fill out digitally.

- Original itemized bills from physicians, hospitals and other medical providers.

- All original receipts for any expenses that you’ve already paid for.

If you have any questions in filling out the form visit the guidelines at www.hccmis.com/claims

Proof of insurance for a visa letter

More and more countries seem to be requiring proof of insurance these days.

If you’re from a country that requires a visa to travel to another country, you may need proof you have an insurance in order to enter.

Note: check if you need a visa to any country here

For example, if you’re applying for a Schengen visa to any EU country, you must provide proof of travel insurance with at least $50,000 in medical emergency benefits (which most travel insurance plans cover).

It’s important you check this out before traveling as well, just so you’re aware.

SafetyWing offers easy access to your proof of insurance letter by logging in with your policy ID on Tokio Marine’s Client Zone. You will be able to download the visa letter in a PDF format in just seconds.

I’m sure this option is available through any travel insurance policy you go with, but I’m in a SafetyWing state-of-mind in this case. “Just sign in your area and get it, save a PDF, send it to whom it may concern…”.

Read: review of iVisa.com – the gateway to organize your visa around the world

Good To Know: We also have a guide on How to Travel on a Budget? Simple Tips for Saving Money on Your Next Trip.

FAQs

Is SafetyWing Nomad Insurance legit?

Yes, SafetyWing is a legitimate travel insurance company which we have had firsthand experience with.

Is SafetyWing good travel insurance?

It’s an excellent choice for digital nomads and anyone else that enjoys bouncing around the world on a long-term travel adventure. The affordable monthly payment options and flexibility make SafetyWing an easy choice.

Does SafetyWing cover trip cancellation?

Put simply: no. Instead, SafetyWing offer what’s called trip interruption up to $5,000.

Who are the best travel insurance companies?

Alongside recommending SafetyWing for nomads, we also think HeyMondo is worth considering. This obviously depends on what kind of travel insurance you are after. Here’s our full review of HeyMondo to help you make the best decision for you.

Summing SafetyWings Up

All things considered: SafetyWing is a really a game-changer when it comes to travel nomad insurance.

It is affordable, covers most everything other travel insurance plans cover, and is simple and easy to use and understand.

There’s no dealing with different insurance companies within your coverage — something that, as an American myself, is a huge weight off of shoulders heavy with years of experience with private healthcare marketplaces and fluctuating premiums/deductibles/stipulations within coverage.

On the other hand, its simplicity doesn’t allow for much wiggle-room if you have specific needs, time restraints, or preferences, which some other plans may allow for by providing multiple coverage options.

Question for you: Have you ever made a claim with Safetwing or HeyMondo?

We would love to hear from you! Please leave a comment below and share your experience in details – both bad and good! this way you help more and more travellers!

Not To-Do’s

Here’s a list of things you think you may be covered for, but actually aren’t.

These are based on a careful reading of the fine print in SafetyWing’s Description of Coverage, but they would probably apply to most other travel insurance plans.

Read: How to Deal with Bed Bugs While Traveling (…and a few Hostel Myths Debunked)

Always best to check the fine print

- Don’t purchase your plan and then immediately go get medical treatment.

Any company will look at this as though you’re trying to scam them, which you probably are if you’re trying to do it.

We specifically asked this question: Can you buy insurance and go instantly to the doctor? NO! They even consider this a real scam. That being said, obviously there is cases you buy a policy and something happens 2 days later. The doctor will have the final say in this in the report he/she files.

- Don’t think that just because you missed a connecting flight due to a delay, you’ll be covered by travel delay insurance.

The delay must be at least 12 hours. If this does happen though, SafetyWing will cover you for up to $100 a day to cover hotel costs.

- Don’t get drunk and crash your motorbike into a muddy ditch, badly cracking both rear view mirrors and both of your legs.

You won’t be covered if your BAC (blood alcohol content) is above the legal limit of the country you’re in.

- Don’t go back to your home country and get a physical or any voluntary testing/procedures thinking that you’ll be covered.

You won’t be.

The only way you’re covered when you go home (and you’re only covered up to 30 days out of a 90 day policy) is if it’s an ‘incidental emergency’, meaning accidental, unplanned, whoops, damn-I-should’ve…splat!

- Don’t get any vaccinations thinking you’ll be covered.

You won’t be covered.

Depending on where you’re going and what vaccinations you may need, check other insurance plans to see what the possibilities are.

If you have a home insurance plan, check out the vaccination options with them as well.

You can usually find safe, affordable vaccination centers if you look in the right places. Preferably not down any dark alleys.

- Don’t go snorkeling without a life-jacket and then nearly drown and need life support

And then expect to be covered if you’ve signed a waiver with a tour company stating that they’re not responsible for anything that happens if you don’t wear a life jacket (including shark attacks).

- Don’t go get your teeth whitened by a dentist in Thailand, thinking that this will be covered.

It won’t be.

Only emergency dental coverage is provided due to severe, agonizing pain from an acute source. Like if you smash your mouth into Thailand and need immediate reconstructive surgery.

- Don’t expect to be covered for treatment for an STD

No matter how hard you try!

- Don’t see a billboard ad for hair transplants as you’re driving down some highway and think ‘hmmm, maybe it won’t be that expensive because of my travel insurance?’

It will be. You won’t be covered, in more ways than one.

- Don’t go to a dermatologist so you can finally get that annoying birthmark that looks like Italy removed from your inner thigh.

That’ll cost you full price, as it is not covered.

Comparison of the travel insurance coverage offered by SafetyWing and an older provider:

Note: prices are based on a 23 year-old US Citizen.

This table shows everything more clearly.

| SafetyWing | Old Insurance Provider | Difference/ Comment | |

| Prices | $42/4 weeks | $118/4 weeks |

250$ deductible for SafetyWing |

| Trip cancellation | No | Yes (Both plans – Standard and Explorer) |

|

| Extending Coverage | Automatic renew (if setup) | Manual | Safetywing is better for long-term |

| Evacuations | Political evacuations and natural disasters | Political evacuations and natural disasters | Same |

| Extreme Sports | Does not cover many extreme sports | Covers more sports (e.g. paragliding parasailing scuba diving at + 10m) |

|

| Personal liability | No cover | covered |

|

| Age Limit | until 69 years | until 64 years | |

| Electronics insured | No | Yes (amount varies on your selected plan ) |

|

| Rental car excess | No cover | Covers loss of car rental key and Rental car excess | |

| Emergency dental treatment | Yes – up to $1,000. | Yes (amount varies) |

|

| Medical emergency evacuation | Yes | Yes |

Please note we are trying to keep this list up to date. Always check first with the insurance directly if the information is still valid. Last update April, 2024.

Some Other Travel Insurance Options

So you made it so far, this is excellent! By now you should have a deeper understanding of what nomad insurance you may need, pricing and such.

Let’s share with you 2 more providers. Above all, we want this guide to be complete and show a full picture.

True Traveller

True Traveller seems like an interesting option. Unfortunately, it’s only available to citizens of the EU and UK.

Their website is quite straightforward and user-friendly.

Just put in some information about where you’re from, your age, and the length of your trip, and you’ll be sent to a comprehensive summary of your coverage options.

There are three main plans, from least to most expensive:

- True Value

- Traveller and

- Traveller Plus

Here are some key highlights

Note: I’m converting into US Dollars from their website, which is in Sterling Pounds.

1. Prices vary based on:

- plan you choose

- your age and

- whether you’ll be traveling to the US or Canada.

Prices are even higher if you buy the insurance when you’re already travelling.

I chose the basic plan, True Value, with no coverage to US or Canada, and choose ‘not traveling’, and 4 weeks would cost me $80.

If I were already traveling, it would cost me $98.

A bit cheaper than World Nomads, but still doesn’t begin to compete with SafetyWing’s $37 $42.

2. Lots of coverage options: As I mentioned above, they offer three types of plans, True Value, Traveller and Traveller Plus.

But, they also offer extra add-ons, like:

- an adventure pack

- extreme pack and

- ultimate pack, which cover increasingly more dangerous bundles of sports and activities.

Two options for a deductible:

- You can choose between having a $0 deductible

- $160 deductible

When I chose the $0 deductible, the price of my quote rose from $80 to $109.

3. High limit for medical expenses: For the basic plan, True Traveller’s medical expenses limit is over $3,000,000.

Yes, THREE MILLION Dollars!

A super generous limit that would cover a lot more costs than either HeyMondo or SafetyWing.

IMG Global

IMG Global is another company with multiple travel insurance options.

And by multiple, I mean multiple.

There are at least 11 different coverage options.

- you can choose between short-term and long-term plans

- whether you’ll be covered in the US or not, and

- you can specify if you’ll be making multiple trips.

Here are some highlights:

1. Coverage Plans: They basically offer three main plans, with more specific sub-plans within them.

The three main plans are:

- Travel Medical Insurance

- International Health Insurance

- Travel Insurance

2. Price: IMG can be SUPER CHEAP, if you’re willing to risk your deductible.

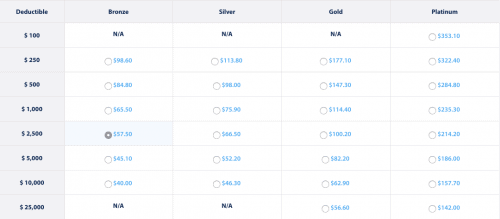

With IMG, the prices really vary because you can choose your deductible, from $100 to $25,000.

Again, remember that the deductible is the amount you pay upfront yourself, and then the insurance company ponies up the rest.

I was interested in their long-term insurance offerings, so I chose to check out their year-long “Global Medical Insurance” with US/Canada travel excluded.

Here were my options:

In other words, if I’m willing to risk a $10,000 deductible, I can pay $42/month. While this may seem worth it to you, it’s really almost like not having insurance at all.

Any treatment you receive under $10,000, you’ll be paying out of pocket. Even still, if you’re into having lots of options, head over to their website and have a look.

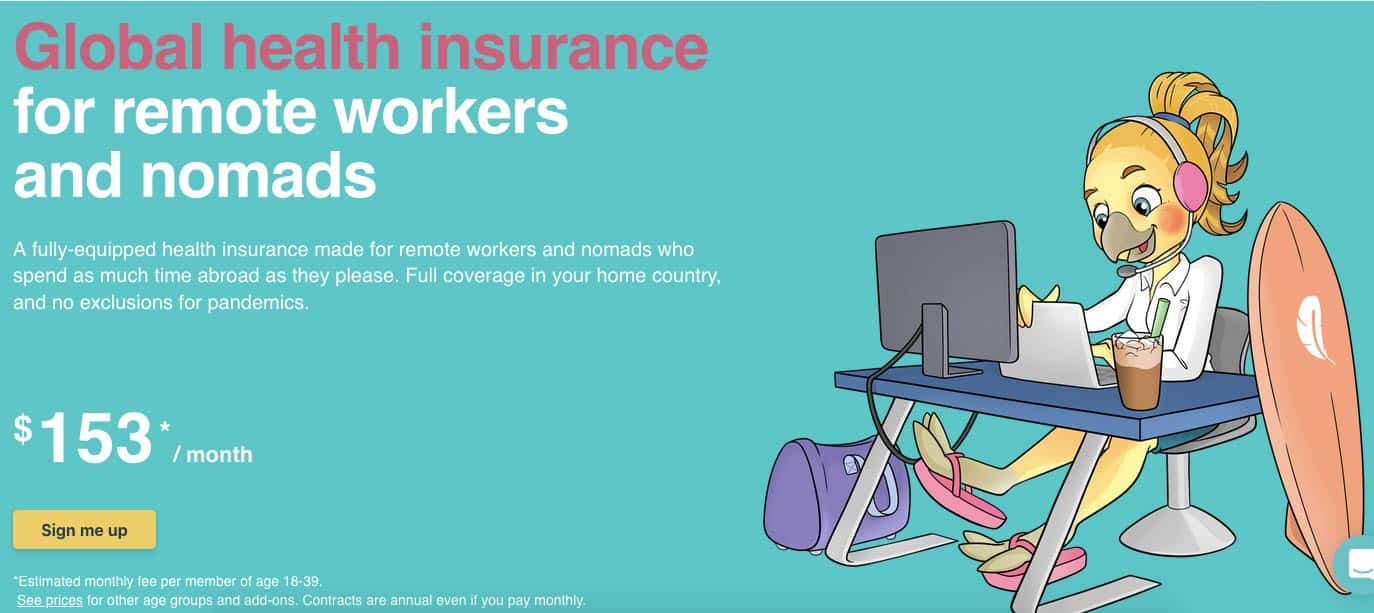

Safetywing Remote Health

Safetywing Remote Health is a Health insurance for your remote team. So this section really only applies to you if you run a team and business.

A fully equipped health insurance that works for your entire international team and independent remote workers. No exclusions for pandemics.

The price depends on the size of your team and the destinations. As always, the US coverage is more expensive while Asia is usually cheaper.

The remote health covers for instance:

- Hospitals treatment and accommodation

Cancer treatment

- Reconstructive surgery

- MRI, PET and CT scans

- Parent and child overnight accommodation

- and many more.

Closing Remarks

Whew! So, if you’re still reading this, then bless your heart. I think you are ready to get travel insurance for nomads.

You’re really into learning about travel insurance and the possible options you have out there.

Remember, it always helps to do your research.

Check out the descriptions of coverage for any company you choose to go with, and be aware that there can be many variables based on you individual situation.

Transparency is key:

We decided to team up with HeyMondo and SafetyWing. Meaning, when purchasing your insurance with them, we will receive a small cut at no extra cost for you. This will help us to keep this page running for you, so we can bring you more insider tips and tricks to travel on a budget and the most stunning hostels in the world.

What else?

Got everything you need about travel insurance worldwide? Read:

- Travel packing list – the only list you need

- HeyMondo Travel insurance review – is it legit?

- what NOT to pack for staying at hostels

- 10 backpacker mistakes to avoid in your next trip

- iVisa, the simple shortcut for your visa around the world

- Sort out onward travel with Onward Ticket

- Our favourite ways to find flights: Skyscanner

- Qatar Airways in review – a great company to fly with?

Your Experience and Feedback

We wrote this article by doing extensive research along with our own personal experience with some of the insurances we’ve used. Now, we would love your experiences and feedback.

We know no company is perfect and there can be situations where we as customers are not happy about the outcome for one reason or another. Therefore, please leave your comment below.

Share your thoughts, opinions and first-hand experiences right here in the comment section.

Travel well, friends.

– – –

Help your travel friends, Share this insider article